Last Updated on 21 September 2022 by automiamo.com

Service Corporation International is an American provider of funeral goods and services as well as cemetery property and services.

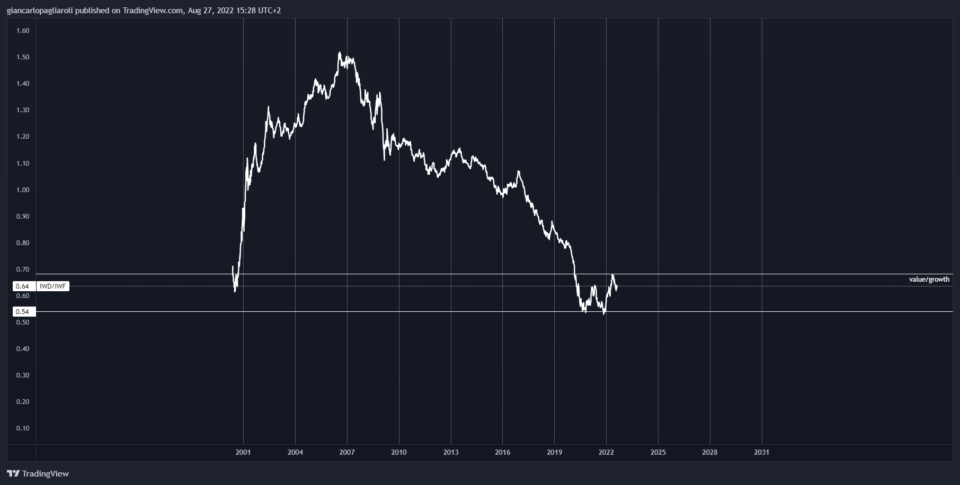

Value companies index is at bottom in comparison with the growth companies.

SCI is a value company leading in one of the most “secure” consumer service and relating to my investment perspective in the “Silver Economy“

In my report finding some concern on debt but the company’s rating is comfortable over last years. ROIC, Return on Invested Capital sounds good to me.

Im developing an app to get financial data from Tradingview and generate a report for my fundamental synthesis and signals.

My automated stock picking on Service Corporation International (NYSE: SCI) available with my app ginvesto.

Here you can download the report in excel format

Statistics related to this sector

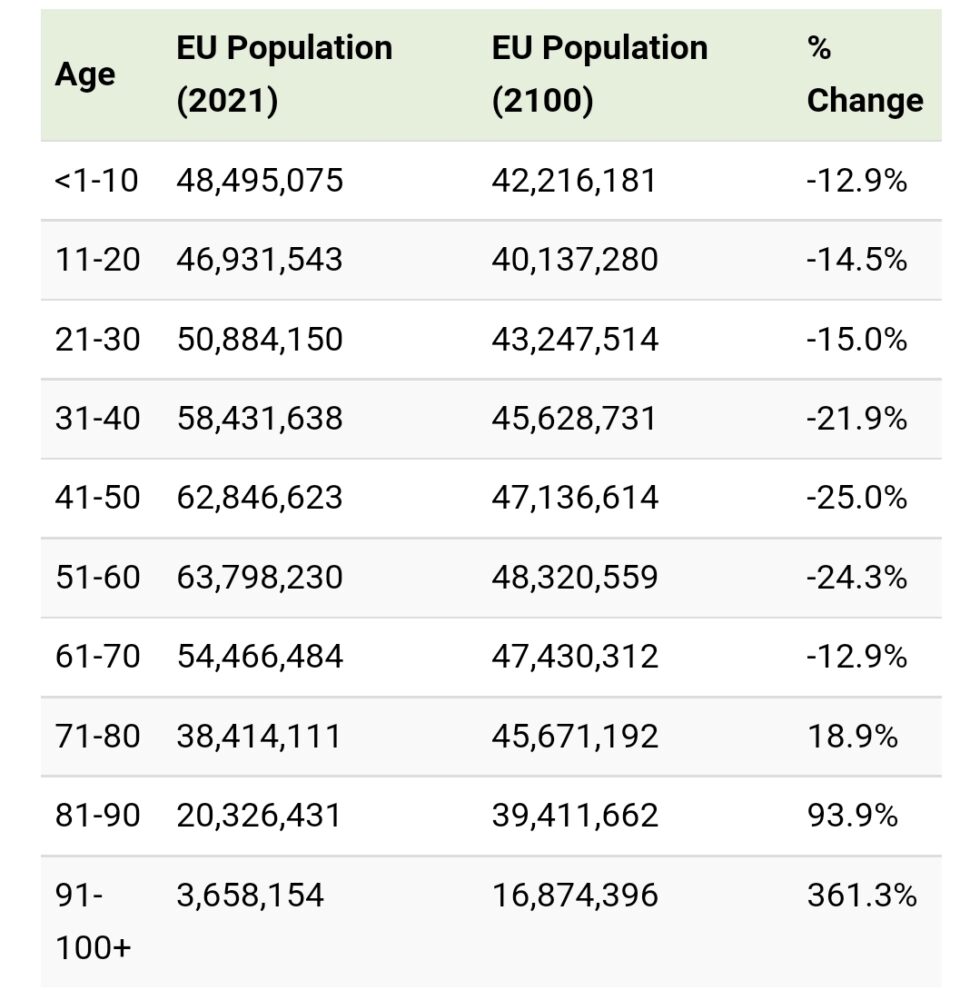

The entire global population is aging. In the table below the EU’s aging population forecast

Giancarlo Pagliaroli

Disclaimer: The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by me.

The entire global population is aging. In the table below the EU’s aging population forecast and how Silver Economy have to be considered in own investment decisions

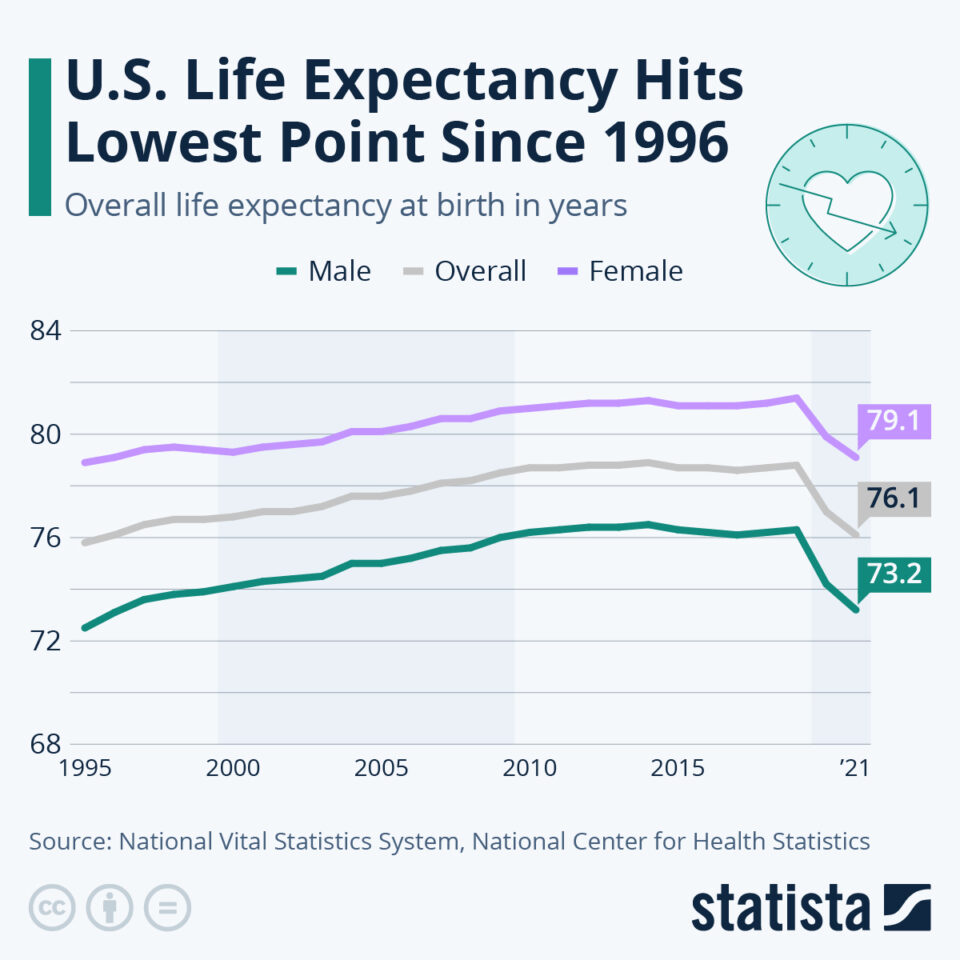

From Statista.com: New government data has found that Americans’ life spans are getting shorter. Where life expectancy at birth was calculated at 79 in 2019, this dropped to 76.1 in 2021. Covid was the main cause

From my report and automatic valuation on historic financial data, the fair value is estimated to be $138 considering earnings is forecast to grow by 26% per annum, P/E is forecast to be 22, over a 3 years of investment horizon.

The fair value is estimated to be $80 relying on future discounted free cash flows and free cash flow is forecast to grow by 12% per annum.

My app signal is respectively BUY – relying on future earnings – and HOLD – relying on future discounted free cash flows –

However this is not to be taken as a buy recommendation but rather be used as a guide only in my investment decisions