Last Updated on 4 September 2022 by automiamo.com

I’m developing an app using Tradingview data for my stock picking and fundamental analysis.

I get financial data from Tradingview into excel file, producing aggregated statistics and fair value calculation based on estimate of future earnings and discounted free cash flows.

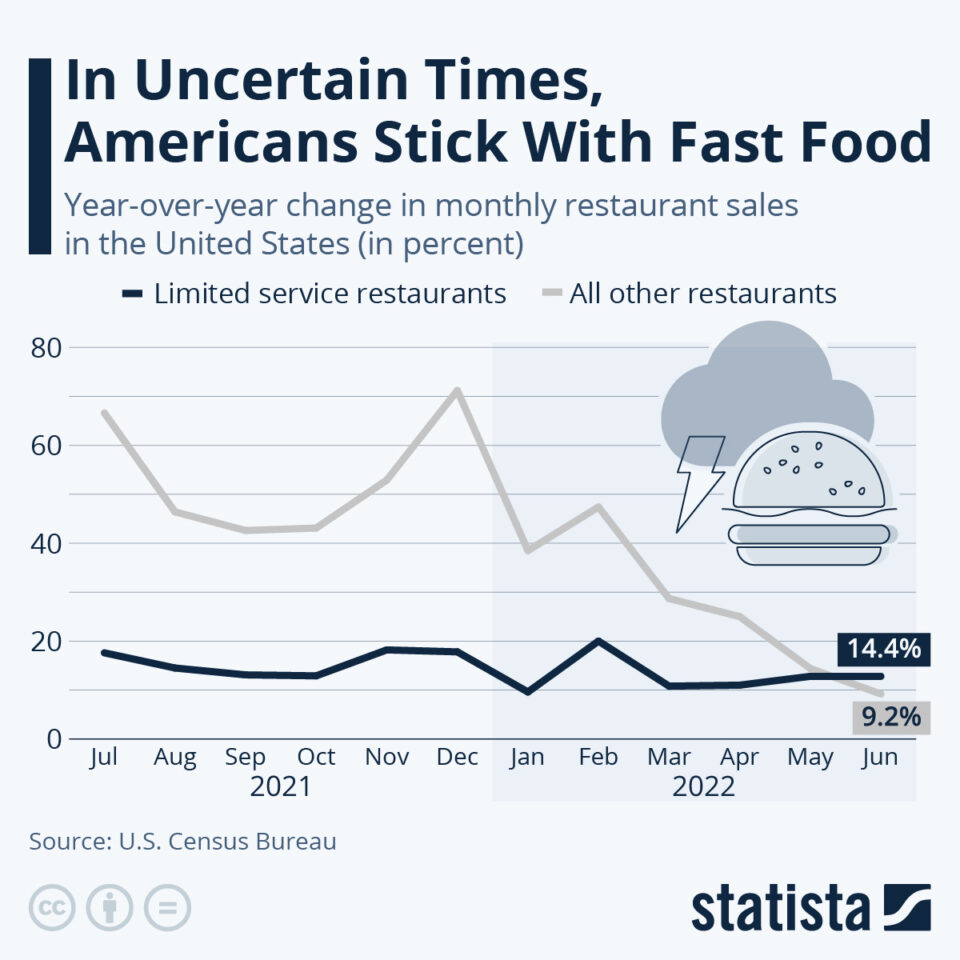

Continuing my search in the best sectors, undervalued stocks that could perform well in the next time. In uncertain times, americans stick with fast food. This stock is popular, resilient, but still overvalued based on my algorithms.

My estimate of fair value is $201 based on forecast earnings and $166 based on forecast discounted free cash flows.

Here you can download my report in excel format.

Giancarlo Pagliaroli

Disclaimer: The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by me.