Last Updated on 18 September 2022 by automiamo.com

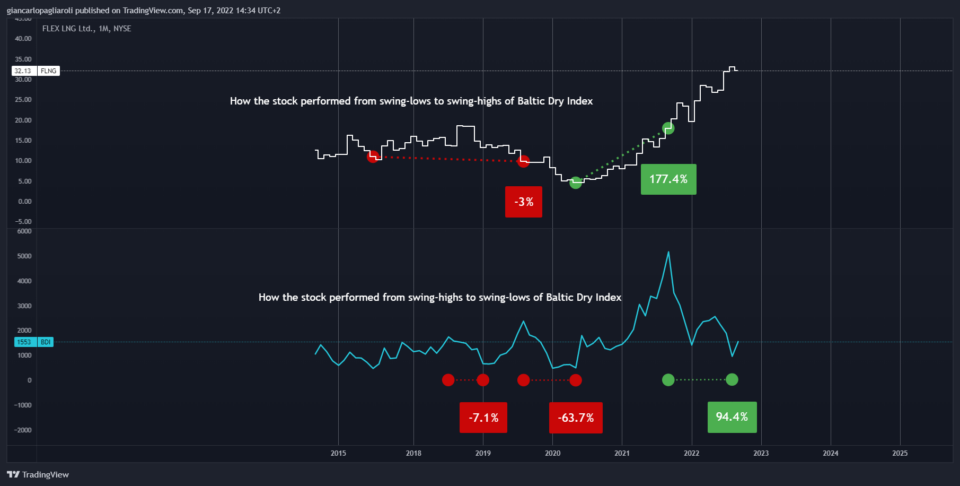

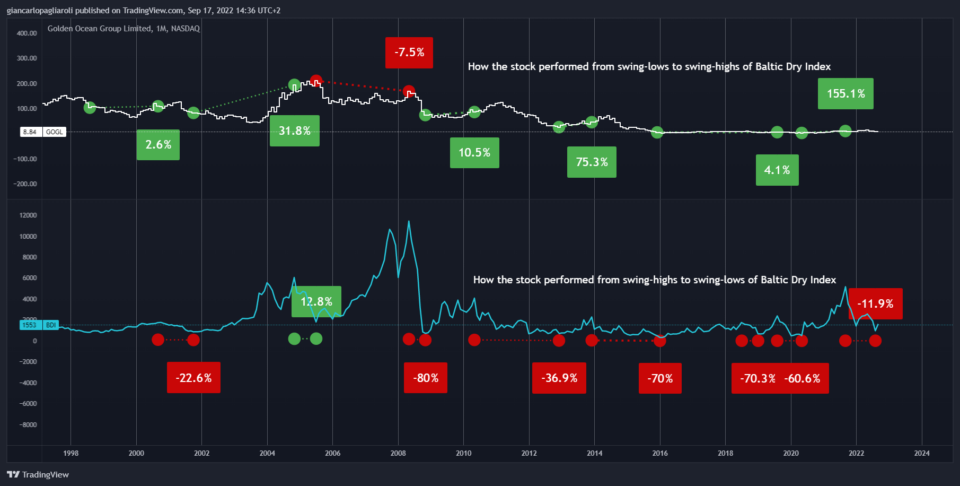

My backtest studying the relation between the Bulk Dry Index and some of popular stocks in marine shipping sector, using CAGR as parameter of performance. CAGR is calculated from swing-high/swing-low to swing-low/swing-high of Baltic Dry index (ticker:BDI) over last years.

Conclusions

- Marine shipping stocks are strongly correlated with the Bulk Dry Index. Stocks often dropping during Index falling and stocks raising during Index raising.

- When Index raising and finding a potential swing-low, I will look for that stock with the highest correlation whit BDI. Through my backtest below, those stocks are Star Bulk Carriers Corp, Knot Offshore Partners LP, Safe Bulkers Inc

Giancarlo Pagliaroli

Disclaimer: The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by me.

New Backtest on Marine Shipping stocks and the Bulk Dry Index