Last Updated on 24 December 2022 by automiamo.com

BASF has successfully developed and tested an innovative Tri-Metal Catalyst technology that enables the partial substitution of palladium with lower-priced platinum in light-duty gasoline vehicles without compromising emissions standards.

BASF collaborated with Sibanye-Stillwater and Impala Platinum to develop this new technology.

The company expects the technology to be implemented from 2023

Slightly more palladium is produced annually than platinum.

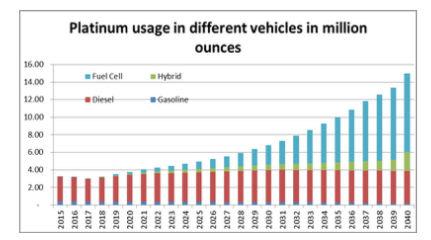

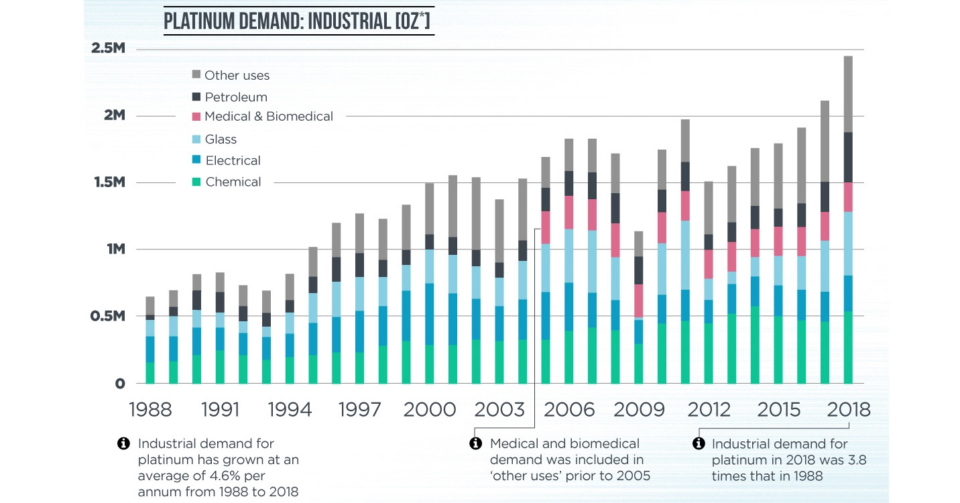

However, current demand for palladium from the automotive catalytic converter industry is about three times more than the demand for platinum because of tightening emission regulations and a market shift from light-duty diesel to light-duty gasoline vehicles

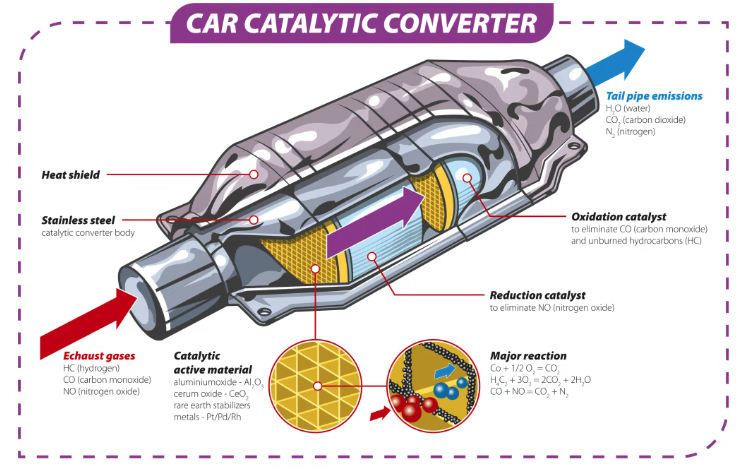

Platinum, palladium or rhodium are all used in vehicle catalytic converters

My automated stock picking

These are fundamental reports automatically generated with my app gInvesto.

BASF SE

BASF SE is a Germany-based chemical company. The Company operates through six segments, which include Chemicals, Materials, Industrial Solutions, Surface Technologies, Nutrition & Care and Agricultural Solutions. The Chemicals segment consists of the Petrochemicals and Intermediates divisions. The Materials segment consists of Performance Materials and Monomers divisions. The Industrial Solutions segment consists of Dispersions & Pigments and Performance Chemicals divisions. The Surface Technologies segment consists of Catalysts and Coatings divisions. The Nutrition & Care segment consists of Care Chemicals and Nutrition & Health divisions. The Agricultural Solutions segment consists of Agricultural Solutions division, which focuses on provision of crop protection products and seeds.

Sibanye Stillwater Ltd

Sibanye-Stillwater Limited is a mining and metals processing company. The Company offers mining and processing operations and projects and investments across five continents. It is the primary producer of platinum, palladium, rhodium and gold. It produces other platinum group metals (PGMs), such as iridium and ruthenium, along with chrome, copper and nickel as by-products. It provides a portfolio of PGM operations in the United States (US), South Africa, and Zimbabwe; gold operations and projects in South Africa, and copper, gold and PGM exploration properties in North and South America. The Company’s gold project in the Southern Africa region includes Beatrix, Cooke, Driefontein, Kloof, RDRGOLD, and Rand Refinery. Its Southern Africa PGM projects include Kroondal, Rustenburg, Mimosa, Marikana and Platinum Mile. Its PGM project in the Americas region includes Stillwater & East Boulder and Columbus Metallurgical Complex. It also offers a portfolio in green metal projects and operations.

Giancarlo Pagliaroli

Disclaimer: The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by me.

Greener alternative in using Platinum: https://platinuminvestment.com/about/60-seconds-in-platinum/2023/02/23?utm_source=Newsletter&utm_medium=email&utm_campaign=60+Seconds+in+Platinum&utm_term=Hydrogen+refuelling

Basing on my automated reports: BASF is actually near the Fair Value (calculated on EPS Forecast): Actual Price: 46, Fair Value 42, Buy Value 34.

Basing on my automated reports: SBSW is actually in the Buy Value (calculated on EPS Forecast): Actual Price: 11, Fair Value 29, Buy Value 23.