Last Updated on 9 September 2022 by automiamo.com

Actually concerns in fear of recession, I would like to backtest focusing on main agricultural commodities over the last 50 years.

I’m using my custom python backtest engine with following logic.

Opening LONG position, every day, on the relative futures contract over the last years. Each trade per day having a duration of 5 and 20 days, in order to reproduce a canonical swing trading operativity

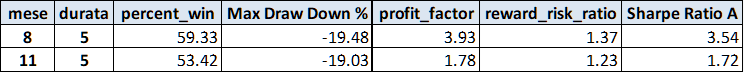

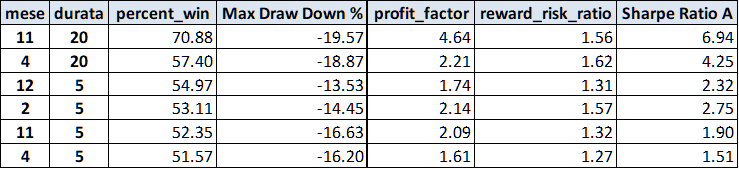

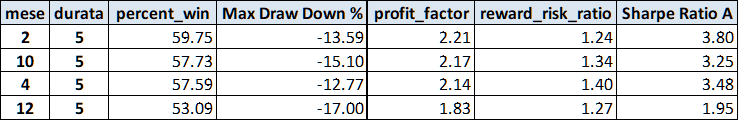

Results in the tables below are grouped by months and duration, with following criteria:

- Max Draw Down % less than 20%

- Profit Factor greater than 1.5

- Annualized sharpe ratio greater than 1

- Percent Win greater than 50%

- Reward Risk Ratio greater than 1

Long story short, let’s see it.

Wheat

Corn

Soy

Giancarlo Pagliaroli

Disclaimer: The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by me.

October good month for soybeans looking my report above. While from the last September’s WASDE Report:

***WHEAT***

– U.S. wheat outlook for supply and use is unchanged this month

– Global wheat outlook raises supplies, consumption, exports, and ending stocks this month, as production increases for Russia and Ukraine, more than offset a decline in beginning stocks. Area harvested, yield, and production for Russia will all reach record highs. The Ukraine production forecast is increased as higher yields in the Forest and Forest-Steppe zones

***CORN***

– U.S. corn outlook is for lower supplies, reduced exports and corn used for ethanol as on reductions to harvested area and yield

– Foreign corn production is forecast higher with increases for China, Ukraine, Canada, and Mozambique more than offsetting reductions for the EU and Serbia. China corn production is raised as abundant rainfall

***RICE***

– U.S. rice this month is for lower supplies. Lowest U.S. rice production since 1993/94

– global outlook is for lower supplies, higher consumption, reduced trade, and lower stocks.

***SOYBEANS***

– US Soybean production is projected down with lower harvested area and yield. Higher cottonseed production.

– Worldwide, Ukraine’s soybean production is raised on higher area. China soybean imports for 2022/23 are lowered 1.0 million tons to 97 million. Global soybean ending stocks are down mainly on lower U.S. and China stocks. EU soybean imports are lowered with higher supplies of other oilseeds.

***SUGAR***

– U.S. sugar stocks are reduced as combined lower production and imports are only partially offset by lower use. Deliveries for human consumption are reduced.

***LIVESTOCK***

– Beef production is raised for the second half of the year with higher expected slaughter for the period. Cattle price forecasts for 2022 are raised on current strength in demand, but forecasts for 2023 are unchanged.

***COTTON***

– U.S. cotton projections include higher beginning stocks, production, exports, and ending stocks this month.

– The 2022/23 world cotton projections include higher production and ending stocks relative to last month, and lower consumption.