Last Updated on 27 September 2022 by automiamo.com

The Commitment of Traders (COT) report is a weekly publication that shows the aggregate holdings of different participants in the U.S. futures market.

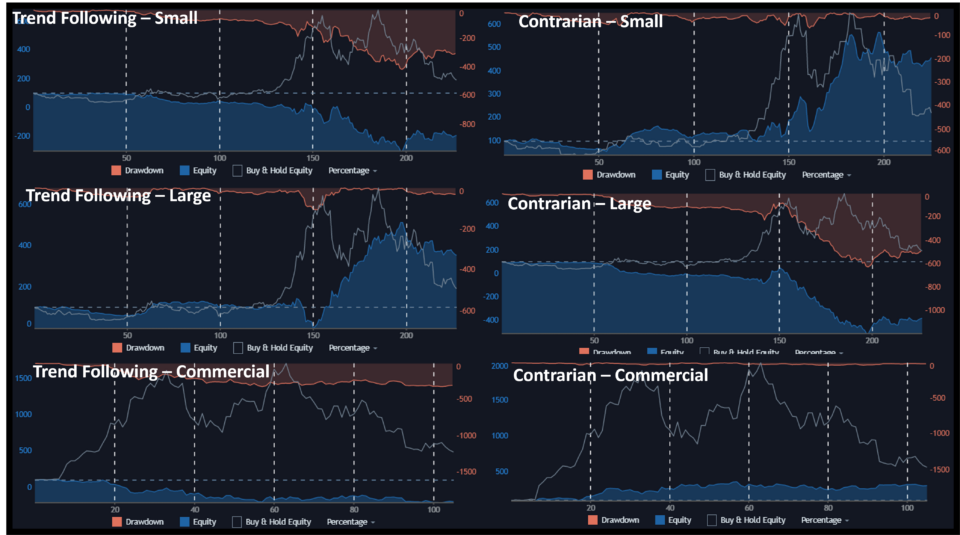

My backtests, using these conditions:

Trend following strategy: LONG in the week, if long % positions on relative forward contract are greater than previous data, else SHORT

Contrarian strategy: SHORT in the week, if long % positions on relative forward contract are greater than previous data, else LONG

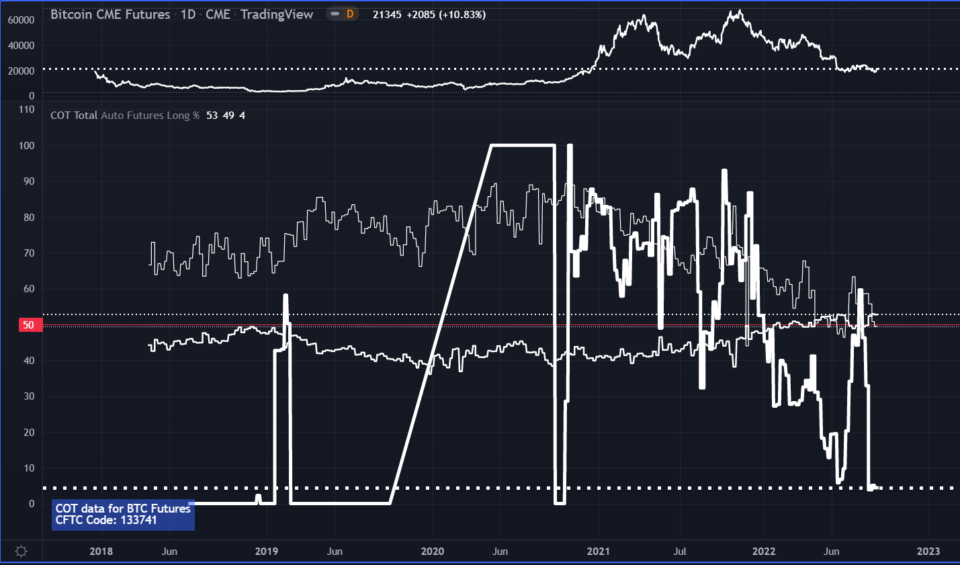

Bitcoin

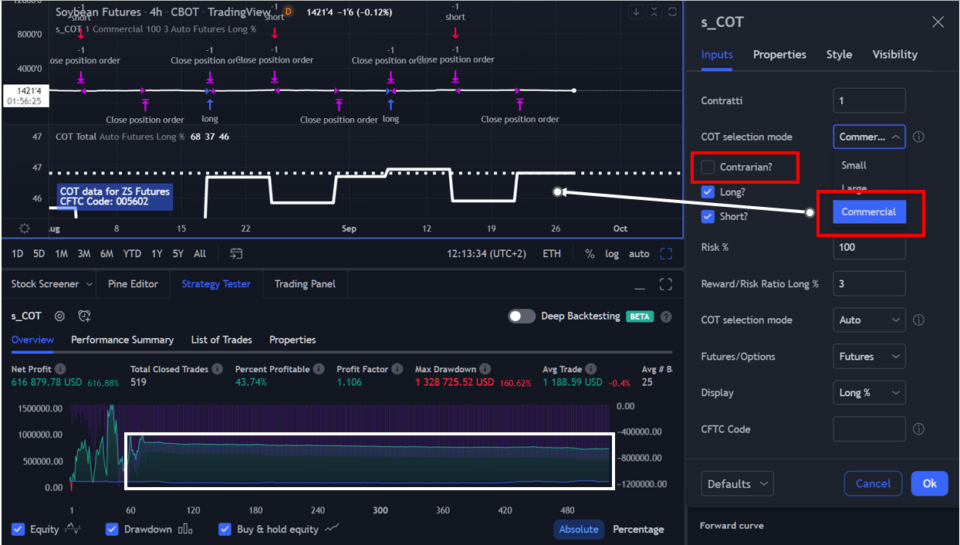

Soybeans

Gold

Giancarlo Pagliaroli

Disclaimer: The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by me.

Added new report COT on BTC: Seems to be good options being following Large Investors or being contrarian than Small Investor